Resolve Your Tax Debt with the IRS and Get Them Off Your Back For Good

Professional tax relief services that can substantially reduce your tax liability, possibly saving you tens of thousands in penalties, interest, and fees.

Trusted & Recognized By

What We've Done for Our Clients

Real results from helping thousands of Americans resolve their tax debt

Tax Debt Resolved

Total since 2018

Tax Years Filed

Helping clients get compliant

Tax Professionals

Dedicated to your success

Years Combined Experience

Resolving Tax Debt

Our Tax Relief Services

Comprehensive solutions to resolve your tax issues and get you back on track

Tax Relief Services

Substantially reduce your tax liability and save thousands in penalties, interest, and fees.

Learn More →Offer in Compromise

Settle your tax debt for less than the full amount owed if you qualify for this program.

Learn More →Penalty Abatement

Remove hefty penalties and accompanying interest through professional negotiation.

Learn More →Wage Garnishment Removal

Stop the IRS from taking up to 70% of your gross income and get back in control.

Learn More →Delinquent Tax Returns

Get back into compliance by filing past returns with optimized results.

Learn More →Installment Agreements

Negotiate reasonable payment plans based on your circumstances.

Learn More →Our Process

Simple, transparent steps to resolve your tax issues

FREE Discovery Call

Free discovery call to find out more about your tax debt situation.

Phase 1: Investigation

Initiate client protection, establish communication with IRS, and review case summary options.

Phase 2: Resolution

Fight to get you the best IRS resolution possible so you can get your case closed and obtain freedom!

Why Choose Alleviate Tax?

We're committed to bringing comfort and ease to your tax situation

We Are Secure & Trusted

Your information is protected with the highest security standards. We are accredited by BBB and trusted by thousands of clients nationwide.

We Are Quality

Our team of tax professionals has helped resolve over $500M+ in tax debt. We fight to get you the best possible outcome.

We Are Tax Relief Experts

With years of experience and deep knowledge of IRS procedures, we know how to navigate complex tax situations and get results.

Hear From Our Clients

Anthony C.

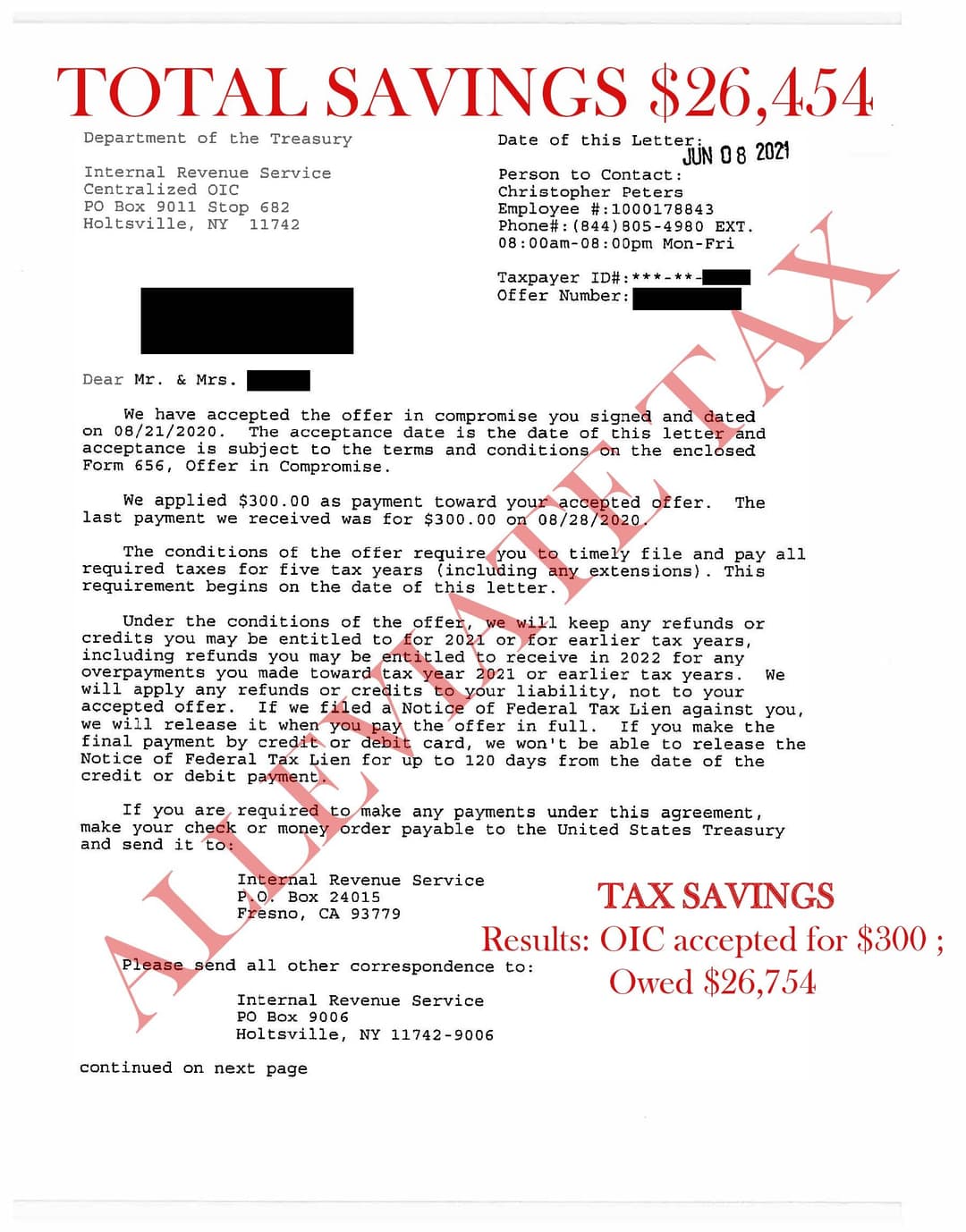

Real Results We've Achieved

Real documents showing the settlements we've achieved for our clients

Offer in Compromise Accepted

See How We've Helped Thousands

Explore our complete collection of client testimonials, documented IRS settlements, and success stories

View All Success StoriesTell Us About Your Situation

If you've been receiving threatening letters from the IRS for an amount that seems impossible, don't fear, there is hope! At Alleviate Tax, our mission is to help you reduce your tax debt to the smallest dollar amount possible.